When rising commodities prices trigger a food crisis, the causes usually seem apparent—drought or weather shocks that reduce crop yields, or decreasing exports that reduce available market supplies, for example. For the past five years, however, IFPRI researchers have been examining if and how another factor influences food prices: The news media.

To understand the impact of media on food prices, IFPRI’s research utilizes the Food Security Media Analysis System (FOMA), an innovative search engine incorporating sophisticated linguistic and semantic object network-mapping algorithms to analyze the relationships between key terms found in media articles about commodity prices and price volatility.

FOMA examines the extent to which public perceptions of global and regional food security situations, as represented by daily global media outlets, align with the actual current food security environment (food prices, stocks, et al). The tool generates daily reports that are used to analyze the impact of media articles about food prices, agricultural markets, and food stocks on the global and regional prices of key staple foods such as wheat, maize, soybeans, and rice.

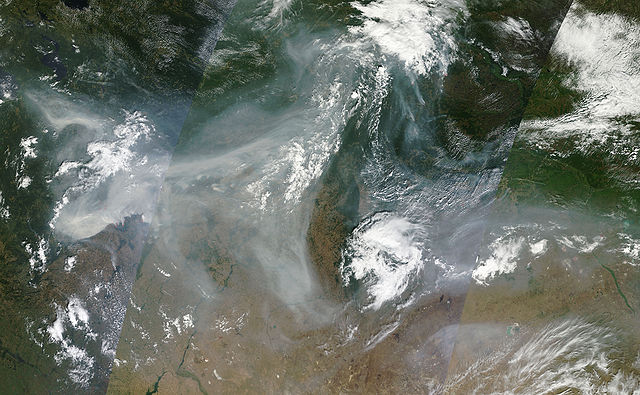

Crisis-driven news coverage fueled volatility in wheat prices during the Russian drought and wildfires of 2010, a FOMA-based analysis shows. At the time, Russia banned wheat exports to protect its domestic stock levels. Although global wheat stocks were then more than adequate to make up for this export decline, the global wheat futures market experienced high volatility for several days after Russia announced the ban. IFPRI research suggests that this market overreaction was driven in part by overwhelming media attention on the damaging effects of the wildfires, and a concurrent lack of attention paid to the reality of existing global stocks. From August through October 2010, every media article covering the price of wheat was accompanied by a spike in price volatility; 57 percent of these articles forecast an increase in global wheat prices (see Chapter 3 of the 2011 Global Hunger Index (PDF) for more information). The lack of information from media sources regarding the true state of global production and stocks led to reactionary responses by governments across the globe to purchase and stockpile, driving prices up further.

In a 2012 paper (PDF), IFPRI researchers Maximo Torero, Miguel Almanzar, and Klaus von Grebmer examined three important elements of global commodity markets (the price level, the returns these levels imply, and the volatility of these markets) and related them to global media coverage of those markets. They focused on maize, wheat, soybeans, rice, and oil during 2009-2012. More news reports of price levels increasing or decreasing (referred to as “ups” and “downs” in the FOMA system) reinforced price movements in that direction, they found, suggesting that increased media attention can in fact exacerbate price increases.

Similarly, returns also increased with media coverage of rising price levels. The results for volatility were less straightforward, however. This may be due to variations in the intensity of media coverage and delayed volatility responses (as changes in volatility are only observed after changes in price levels). The authors also found that the variability of commodities’ returns and prices tended to decrease as additional media attention was paid to the situation in those markets. This suggests that media coverage also has the potential to reduce price volatility.

The latest version of FOMA, launched earlier this year, allows users to search for related key words and phrases at both the article level and the sentence level; this new function lets researchers drill down and gain a clearer picture of the links between the language of media coverage and effects on commodity markets. The enhanced system also now generates reports on Spanish and French sources to allow for broader analysis of news from non-English-speaking countries.

FOMA can also gauge media accuracy by scanning content from multiple international outlets and identifying factors the media present as impacting food prices, then comparing those to actual data such as global stock levels. Decreasing any potential information gaps may be a key step in calming food markets and preventing further price volatility and food crises.

Sara Gustafson is a Communications Specialist with IFPRI’s Markets, Trade and Institutions Division.