Three factors often characterize the financial reality for the poor: Low incomes, unstable cash flows and a lack of access to formal credit and insurance products. In this environment, it is important for households to save for future investments and emergencies, but savings rates in many developing countries remain low. A new study in the Journal of Development Economics (JDE) by Wendy Janssens and Lisette Swart of Vrije Universiteit Amsterdam, and Berber Kramer of IFPRI, takes a closer look at the behavioral economics behind savings among rural households in Nigeria.

Low savings are often explained by a behavioral concept known as hyperbolic discounting: When people have to choose between a smaller payment soon, versus a larger payment later, they are less patient the closer this trade-off is to the present. For example, a hyperbolic discounter may strongly prefer to receive $10 today over $11 tomorrow, but makes less of a distinction between waiting 30 or 31 days, and may even prefer $11 in 31 days over $10 in 30 days (pattern A). But when day 30 arrives, she will opt to take the $10 immediately again (pattern B).

Several studies have found evidence of pattern A, and other studies have found evidence of pattern B. And these findings, in turn, have been used to validate the idea that hyperbolic discounting prevents households from saving more, and justify the introduction of hard commitment savings devices that lock people’s money away for a period of time.

The JDE study, however, shows that we should exercise caution before concluding that hyperbolic discounting is actually the reason for these changes in economic preferences. People may also be responding to changing material circumstances; failing to take this into account may produce “false positives” for hyperbolic discounting.

Two conditions must be met to demonstrate that a particular individual engages in hyperbolic discounting. She must violate stationarity—that is, her economic preferences are not fixed, but change depending on the time horizon. For instance, her preferences for trade-offs tomorrow will differ from those for trade-offs 30 days away (pattern A). She must also violate time consistency: Her stated economic preferences change as time passes. As the 30-day deadline approaches, she opts to receive money sooner than she indicated back on day 1 (pattern B).

Both types of “present bias” provide a sensible explanation for why we often fail to carry through our plans to save. But why must both these conditions be met? In other words, why is finding a violation of time consistency or stationarity alone not enough to infer hyperbolic discounting?

The answer is simple. Taken in isolation, either condition can be explained by a fact of life for the poor: A person’s actual economic situation can change. Her choices may be different for different time periods, not because of an inconsistency in underlying preferences, but because of economic uncertainty and changes in real-world conditions. For instance, today a person prefers to wait one day to receive $1 extra, whereas one month from now, some urgent need has arisen and she may prefer to receive $10 immediately rather than $11 one day later. This is called a violation of time invariance, or a change in stated preferences as time passes. When day 30 arrives, a person who had one set of preferences on day 1 now makes different choices for the present and the future.

In developing countries, such changes in preferences very likely occur precisely because incomes and expenditures are unpredictable and households lack access to sound insurance and credit mechanisms. Savings decisions in such an environment can be impacted by life events, both expected and unexpected: School fees, payments to workers to help cultivate or harvest crops, or a child falling ill, for example. Studies that look at either violations of stationarity or violations of time inconsistency fail to take into account the unstable economic circumstances that lead to time invariance, which may result in a misunderstanding of the true causes behind households’ consumption and savings patterns.

The study in Nigeria therefore examined whether a sample of 240 rural participants violated both time consistency and stationarity (thus providing evidence that hyperbolic discounting was at play) or whether participants violated only one of the two (in which case these preference reversals should be attributed to violations of time invariance).

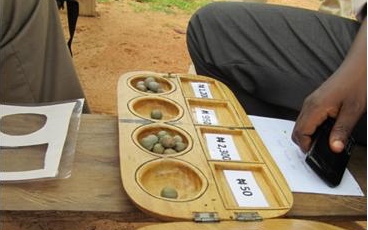

The study took place in Kwara State from April-July 2012 (the period between planting and harvesting, when many households face increased needs for cash). Participants received ten vouchers for future payments. For each voucher, they could choose whether to receive the payment on one of two future dates: A “sooner” date, or a “later” date exactly one month after the “sooner” date. Vouchers allocated to the later date were worth 200 Nigerian Naira (approximately $0.65 at today’s rates), while vouchers allocated to the sooner date were worth either 200, 150, 120, or 100 Naira. So, vouchers chosen for the “sooner” date never exceeded the value of those for “later” dates, and participants would always earn more money in total by allocating all 10 vouchers to the later date.

Three scenarios were used for the allocation of vouchers (see the figure below): 1. a first-round allocation in which the sooner payment date was tomorrow and the later payment date was “one month from now”; 2. a first-round allocation in which the sooner date was “two months from now” and the later date was “three months from now”; and 3. a second-round allocation conducted two months later, in which the sooner payment date was again “tomorrow” and the later payment date was again “one month from now”.

If participants made different choices between allocation 1 and allocation 2, their preferences varied depending on scenario’s time frame—evidence of a violation of stationarity. If participants made different choices between allocation 2 and allocation 3, their previously-indicated choices for the second round had changed over time–evidence of a violation of time consistency. Finally, time invariance was violated if a participant made a different choice between allocation 1 and allocation 3—in other words, the person’s apparent patience level had changed in the intervening two months.

The results show that violations of time consistency and stationarity usually did not overlap: Only 10.4 percent of participants violated both concepts in the same present-biased way; thus, violations were mostly observed in isolation, and hyperbolic discounting did not seem to be the main driver behind participants’ behavior.

Instead, the study finds evidence of changes in material conditions driving behavior. Participants with present-biased violations time consistency but not stationarity were found to have significantly less access to informal credit—and their financial position, measured in terms of net wealth, had deteriorated more over time than that of other participants. Having less access to credit means that people are unable to absorb shocks effectively and smooth their consumption when there is a change in their financial status. For households facing more binding liquidity constraints, any financial shock that deteriorates their financial position will likely make them revise their financial decisions when they have a chance, resulting in violations of time invariance.

These findings have implications for both future research and policy making. They suggest that violations of time invariance play a strong role in poor households’ limited ability to save; thus, future studies should take time invariance into account when attempting to establish the presence of hyperbolic discounting. Rather than relying solely on measures of time consistency or stationarity, it is important to measure both, and analyze whether study participants consistently violate the two concepts in a present-biased way.

For policymakers and development practitioners, these findings have important implications for the design of financial tools, such as commitment savings devices. Specifically, the study suggests that such tools need to include a certain amount of flexibility in order to be effective. For households with limited access to credit and insurance and with more volatile incomes or expenditures, “softer” commitment savings plans with more flexibility can be more useful because they allow individuals to tailor their savings to fluctuations in their financial situations, and to withdraw savings in times of financial constraints. Better understanding how people’s savings decisions are impacted by both hyperbolic discounting and liquidity constraints can help policymakers and development practitioners ensure that financial tools help the poor achieve their savings and investment goals without compromising their ability to smooth consumption and ride out financial shocks.

Sara Gustafson is a Communications Specialist and Berber Kramer is a Research Fellow, both with IFPRI’s Markets, Trade and Institutions Division.