Economic theory tells us that price plays an important role in determining demand for goods and services. When prices fall, demand rises. Demand curves, therefore, typically slope downward. Thus, discount vouchers (in the private sector) and subsidies (in the public sector) are popular, evidence–backed mechanisms for reducing consumer prices and promoting demand—and in particular, expanding the use of quality inputs and other agricultural technologies among smallholder farmers.

Yet lowering prices via discount or subsidy is only one factor influencing the successful, consistent use of such products—in particular, the timing of take-up can be crucial. Seeds, fertilizer, pesticides, etc. often need to be applied within specific and narrow time windows to maximize their benefits. If new agricultural inputs don’t perform well, then farmers may forgo purchasing them in the future. Thus, the success of both private and public sector efforts to stimulate demand may depend not only on if potential consumers purchase a product but also on when they purchase and use it.

Preliminary results from an ongoing randomized controlled trial in northeastern Nigeria allow us to directly investigate how providing discount vouchers affects both take-up rates and the timing of these purchases. In this study, we partnered with a local agricultural input dealer to promote the purchase of a bundle of agricultural inputs—including biofortified seeds, fertilizer, crop protection products, and insurance—among smallholder farmers. We designed an intervention using two main promotional tools commonly employed by agricultural input dealers: Marketing campaigns and price discounts. A total of 2,300 farmers from 230 communities in Gombe State, Nigeria were randomly assigned, at the community level, to one of the following four groups:

- Treatment 1: Marketing information only

- Treatment 2: Marketing information + 50% discount vouchers

- Treatment 3: Marketing information + 75% discount vouchers

- Control: No marketing information or discount vouchers

This experimental design allows us to study the effect of marketing information plus the additional effects of two different price discount levels on take-up rates of the agricultural inputs bundle. In this preliminary analysis, we focus on take-up, defined as whether the farmer purchased the bundle within the time frame of our study (between mid-May and the end of June 2024). In a subsequent analysis, we will examine if other downstream outcomes (i.e., agricultural production and consumption patterns) change in line with the random assignment to the treatment in our experiment.

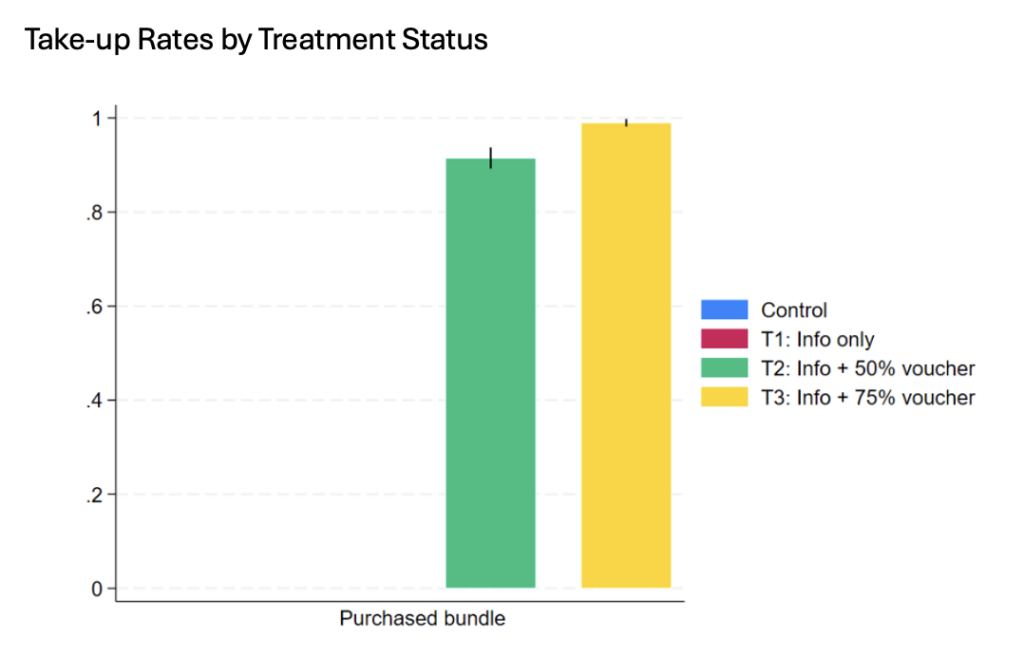

Figure 1 plots take-up rates by treatment status. Zero farmers from either the control group or treatment group 1, receiving only the marketing information, purchased the bundle during the study period. This can largely be attributed to price volatility in agricultural inputs—especially fertilizer—in Nigeria during the implementation of our study. Shortly after our study began, the prevailing market price of the components in the bundle fell by 10%. Additionally, in mid-June the governor of Gombe state implemented a policy that provided a 50% subsidy on the purchase of a 50 kg bag of NPK fertilizer—lowering the market price of the components in the bundle by an additional 15%. These reductions resulted in prevailing market prices lower than the price of the bundles marketed to farmers in treatment group 1—discouraging them from purchasing the bundle throughout the study period. By contrast, in treatment groups 2 and 3 the price of the bundle with the provided discount vouchers applied was sufficiently lower than the prevailing market price, leading to substantial—and nearly universal—take-up rates. In treatment group 2, 92% of farmers purchased the bundle. And in treatment group 3, 99% purchased the bundle.

Figure 1

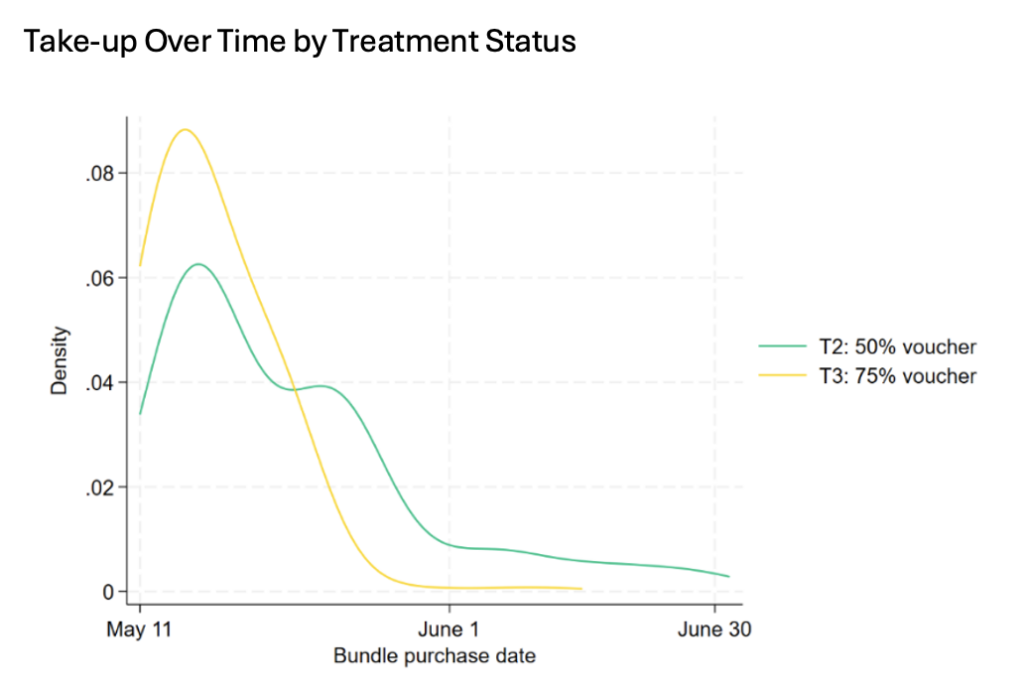

The take-up rates shown in Figure 1 tell us only how many farmers in each treatment group purchased the bundle; they do not tell us anything about when farmers decided to purchase the bundle during the study period. Figure 2 focuses on farmers in treatment groups 2 and 3, as these are the groups where we observe take-up, and shows the density of take-up during the study period. In both groups, we observe an initial spike in purchases at the start of the study period followed by a gradual decline. This spike is higher, and the decline is steeper, among farmers in treatment group 3 compared to those in treatment group 2.

Figure 2

Additionally, regression results show that while there is no difference in the timing of household marketing visits between treatment groups 2 and 3 (p-value = 0.619), there is a statistically significant difference in the timing of take-up on average between treatment groups 2 and 3 (p-value = 0.00). Moreover, a Kolmogorov–Smirnov test for equality of distribution functions shows that these two temporal distributions are statistically different from each other (p-value = 0.000).

These results demonstrate that although the take-up rates are similar between treatment groups 2 and 3, the higher discount voucher provided to treatment group 3 encouraged farmers to purchase the bundle more quickly than those in treatment group 2. The median farmer in treatment group 2 purchased the bundle nine days after the start of the study, while the median farmer in treatment group 3 purchased the bundle only five days after the start of the study, in just over half the time.

The differential timing in take-up could be driven by a “wait and see” approach among farmers treatment group 2. While motivated to purchase the bundle, perhaps they waited a few days before acting in order to observe trends in prevailing market prices (which may depend on weather conditions and government subsidies), to see if prices would fall even further. This mechanism aligns with qualitative reports from our household marketing visits, where initial interest in purchasing the bundle was high and seemed to largely depend on price. In treatment group 1, 91% of farmers said they planned to purchase the bundle, while in treatment groups 2 and 3 nearly all farmers said they planned to purchase it. Allowing for multiple responses, among farmers who didn’t plan to purchase the bundle, 88% said this was because it was too expensive, and 19% said that the agro-dealer was too far away.

Future work analyzing data collected with a subsequent endline survey will help us understand what—if any—effects persist due to the delayed take-up observed among farmers from treatment group 2, relative to farmers from treatment group 3. For example, do these differences in take-up timing result in corresponding differences in agricultural production outcomes? If so, do these differences also appear in food consumption outcomes or other measures of household welfare? Answering these questions will allow us to move beyond simply understanding how price influences purchasing decisions and assess how the timing of take-up influences purported benefits.

Mulubrhan Amare is a Senior Research Fellow with IFPRI’s Development Strategies and Governance (DSG) Unit; Temilolu Bamiwuye is a DSG Research Analyst, based in Nigeria; Kate Ambler is a Senior Research Fellow with IFPRI’s Markets, Trade, and Institutions (MTI) Unit; Jeff Bloem is an MTI Research Fellow; Rewa Misra is the Head of National Policy and Innovative Financing in the HarvestPlus section of IFPRI’s Innovation Policy and Scaling Unit.Julia Wagner is an MTI Research Analyst. This post is based on research that is not yet peer-reviewed.

Support for this work was provided by the CGIAR Initiative on Fragility, Conflict, and Migration, the Norwegian Agency for Development Cooperation (Norad), and the United States Agency for International Development through the Nigeria Agriculture Policy Activity (NAPA) and the Policy Support for Economic Growth (PSEG) activity.