Statement of Joseph W. Glauber

Senior Research Fellow, International Food Policy Research Institute

Before the Senate Finance Committee *

July 29, 2020

Chairman Grassley, Ranking Member Wyden, and distinguished Members of the Committee, thank you for the opportunity to testify before this committee on the current state of agricultural trade and the World Trade Organization. I am currently a Senior Research Fellow at the International Food Policy Research Institute and Visiting Scholar at the American Enterprise Institute. Prior to coming to IFPRI in 2015 I spent over 30 years at the US Department of Agriculture where I served as Deputy Chief Economist from 1992 to 2007 and Chief Economist from 2008 to 2014. In addition, from 2007 to 2008 I served as Special Doha Agricultural Envoy at the office of the U.S. Trade Representative where I was the US chief agricultural negotiator in the Doha talks at the World Trade Organization.

Global agricultural trade has seen tremendous growth since creation of the WTO in 1995 and US agriculture has been a major beneficiary of the rules-based system that the United States and others helped create. The challenges to meet growing global food demand include population and income growth and supply uncertainties complicated by a changing climate, environmental pressures and water scarcity. All of those point to the increasing importance of trade and need for a more, not less, open trading system. A strong WTO is critical to helping meet future food needs.

Agriculture in a Rules-Based Global Trading System

Today, almost 25 years after the creation of the WTO, many may have forgotten the state of the trading environment facing agriculture in the 1980s. D. Gale Johnson, a prominent University of Chicago economist, referred to it as a “world in disarray.” Many markets were highly protected through high tariffs, limited quotas, or outright bans on imports. Variable levies were in place in many countries, which allowed countries to adjust tariff levels to protect domestic markets as world prices fell or rose. Domestic support to agriculture, particularly among the rich developed members such as the US, Japan, and the EU, was large and growing. Producers in those countries made production decisions largely insulated from the world market. Governments propped up domestic prices by storing production in large public stockpiles, by maintaining high tariff barriers, or both. Governments dumped surplus production on export markets, using export subsidies and restitutions. This further distorted markets and harmed other exporters, often developing countries that had little or no means with which to protect their own producers and limited recourse within the General Agreement on Tariffs and Trade (GATT) to redress trade disputes.

The Uruguay Round Agreement on Agriculture (AoA) brought substantial discipline to the areas of market access, domestic support, and export competition. Under the AoA, members agreed to convert non-tariff barriers to tariff equivalents and, where necessary, to guarantee minimum access to domestic markets through the creation of tariff-rate quotas (TRQs). Developed countries were required to cut tariffs (the higher out-of-quota rates in the case of tariff quotas) by an average of 36 percent in equal steps over six years. Developing countries were required to cut tariffs by an average of 24 percent over 10 years. Several developing countries also used the option of offering tariff ceilings in cases in which duties were not “bound” (that is, committed under GATT or WTO regulations) before the Uruguay Round.

In the area of export competition, export subsidies were capped and then reduced in both value and volume. In Nairobi in 2015, WTO members agreed that developed countries would immediately remove export subsidies except for a handful of agriculture products and that developing countries would do so by 2018 (with a longer time frame in some limited cases).

Finally, under the AoA, domestic support levels were bound and subject to reduction commitments (20 percent reduction over six years for developed countries and 13 percent cuts over 10 years for developing countries). Countries were encouraged to adopt support policies that had minimal production- and trade-distorting effects and that were exempt from reduction commitments (so-called green box policies).

Growth in global agricultural trade

Global agricultural exports have more than tripled in value and more than doubled in volume since 1995, exceeding US $1.8 trillion in 2018 (figure 1).

Rapid growth over the period 2000-2010 was due largely to increases in commodity prices, reflecting the impact of several factors on agricultural commodity markets. These included a substantial expansion in biofuel consumption, higher energy prices, relative price effects associated with a weaker US dollar, and shifts in consumption patterns in emerging economies such as China that favored meat, dairy and other high value products. Since 2013, large global harvests and a slowdown in the demand for biofuels have caused cereal and oilseed prices to decline from peaks reached in 2012-13. Yet while agricultural prices have declined somewhat since 2014, trade values and volumes have continued to climb. And while the coronavirus pandemic is expected to sharply curtail overall trade in manufactured goods, food exports will likely be less affected for the simple reason that people must eat.

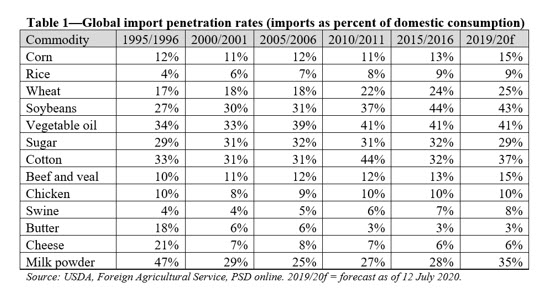

As trade levels have grown, so too, has the importance of trade in meeting domestic food needs. In 2019, for example, one quarter of wheat consumed in the world was obtained from imports (table 1). Even for rice, for which in most countries consumption is overwhelmingly met from domestic production, globally import penetration more than doubled (from 4 percent to 9 percent) over that period. Soybean imports accounted for about one-quarter of global consumption in 1995; by 2019, such imports accounted for about 43 percent of consumption. Import penetration for vegetable oils also increased at a similar rate. In the meat sectors, both beef and swine imports have increased relative to global consumption. Import penetration for chicken meat has remained relatively flat at 10 percent, but global chicken consumption has more than doubled since 1995. Import penetration rates for some dairy products such as butter and cheese are lower than rates in 1995 partly as a result of WTO export subsidy disciplines imposed on large dairy exporters like the United States and European Union who had previously used concessional sales and export subsidies to manage surpluses caused by high domestic price supports. Imports of skim and whole milk powder continue to grow in importance in global dairy trade and now account for 35 percent of global consumption.

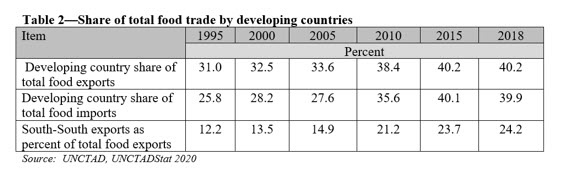

As global trade has grown over the past 25 years, an increasing share of exports and imports has come from developing countries. From 1995 to 2016, the share of total food imports and exports accounted for by developing countries grew from 26 percent to 39 percent and from 31 percent to 40 percent, respectively (table 2). If intra-EU trade is excluded, developing countries’ imports and exports accounted for almost 60 percent of global food trade in 2016. South-South trade (that is, trade between developing countries) also increased, accounting for over 24 percent of total trade in 2018 compared to 12 percent in 1995.

These trends are projected to continue over the next 35 years. The Food and Agricultural Organization of the United Nations projects that global food demand is expected to increase by as much as 50 percent from 2012-2013 levels by 2050, as trends in population growth, urbanization, and income growth are projected to continue, particularly in developing countries. Population projections by the United Nations suggest that 98 percent of the population growth expected between 2015 and 2050 will likely come from developing countries, with Africa south of the Sahara accounting for more than 55 percent of that growth. With income growth rates and urbanization rates also projected to be higher in developing countries, much of the global demand growth for meats, dairy, fruits and vegetables, and processed food products will continue to come from these economies.

US agricultural trade

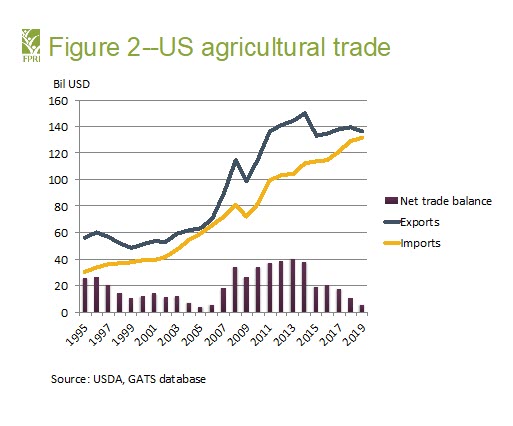

US agricultural trade has benefitted greatly from the rule-based system of trade ushered in by the WTO. US agricultural exports totaled almost $137 billion in 2019 (figure 2).

Exports have more than doubled since 1995, though they have remained relatively flat since 2015, in part due to the trade war with China (see below). Agricultural imports have increased as well over the period, totaling $131 billion in 2019. Much of what the US imports is either not grown much here (for example, coffee and cocoa) or is produced counter-seasonally (for example, asparagus and blueberries). Counter-seasonal imports have enabled US consumers to purchase most fruits and vegetables year-round, which has led to increased per-capita consumption of those foods, and have largely supplemented, not replaced, domestic production.

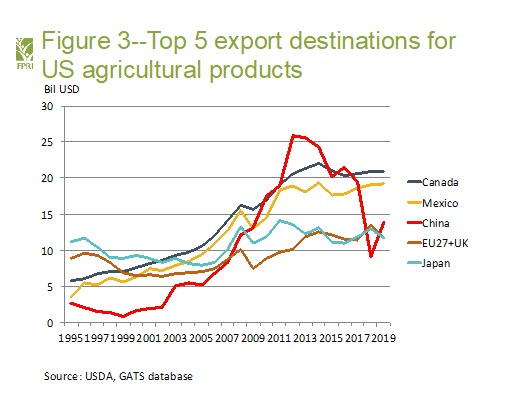

Five markets–Canada, Mexico, China, Japan and the EU (plus the UK)–account for about 60 percent of agricultural exports from the United States (figure 3).

Twenty-five years ago, Japan and the EU were the number one and two markets for US agricultural exports, followed by Canada, South Korea, Mexico and China. With implementation of NAFTA, Canada and Mexico became increasingly more important trading partners and by 2005 had surpassed the EU and Japan as the top US agricultural export destinations. Since then, exports to the EU and Japan have remained relatively flat while that of Mexico and Canada have continue to grow. With the accession of China to the WTO in 2001, US agricultural exports to China began to increase significantly. By 2012, China had surpassed Canada as top market for US agricultural exports and remained as either the number one or number two export destination through 2017. In 2017, for example, the US agricultural exports to China totaled $19.5 billion. Soybeans accounted for about $12.2 billion, or 62 percent of the total. To put this in perspective, production from almost 1 in every 4 rows of soybeans harvested in the United States that year ended up in China where it was processed into protein feed for hog and poultry operations and soybean oil that was bought by China consumers.

A world again in disarray?

Despite the substantial growth in global agricultural trade since 1995, there are a number of cross currents that bode poorly for the world trading system.

Trade wars have threatened trade growth. The recent trade wars between the US and China, Mexico, Canada, and other trading partners have been well documented by others. [1] In 2018, in response to tariffs placed on China goods by the United States, China placed counter-retaliatory tariffs on a number of US agricultural exports, including soybeans. Total US agricultural exports to China fell to $9.1 billion and soybean exports fell by almost 75 percent, to $3.1 billion, the lowest level since 2006. Brazil was a big beneficiary as China sourced most of its soybeans imports from them in 2018 and 2019, and while the United States was able to send some of its soybeans to markets that would have normally imported from Brazil, overall, US soybean exports fell by $4 billion in 2018 and $3 billion in 2019.

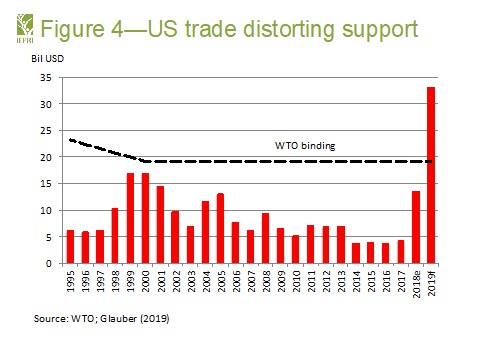

US farm receipts fell in 2018 and 2019 and the Trump Administration responded by providing $28 billion to farmers and ranchers adversely affected by the trade actions. Those payments, combined with payments under the price and income support program and federal crop insurance program, have significantly increased trade-distorting support reported to the WTO. US trade-distorting support will likely exceed its WTO bindings ($19.1 billion) for 2019 (figure 4).[2]

Under the Phase 1 agreement signed in December 2019, China has agreed to import $36.5 billion in US agricultural goods in 2020. Thus far, China agricultural imports from the US through May totaled $7.5 billion, suggesting that imports over the remainder of the year would have to be more than 2.5 times more per month than in the first five months. While outstanding sales to China have been substantial, it is unlikely that the $36.5 billion target will be met. Nonetheless, those sales, if completed, may bring US agricultural export totals back to more historical levels. USDA will publish an updated forecast of US agricultural exports in late August.

Progress in multilateral negotiations since the Uruguay Round has been limited. While the Doha Development Agenda (DDA) was launched with much anticipation in 2001, members failed to reach agreement in July 2008 and the trade agenda in Geneva has since advanced slowly. Serious efforts were made to renew the negotiations, but in the end, members have had to be content with harvesting the low-hanging fruit, such as trade facilitation and export competition. Although there have been significant accomplishments, they represent but a small portion of what was on the table during the DDA negotiations. In addition, negotiated settlements on the tougher issues, such as market access and domestic support, have become more difficult to obtain in isolation. The recent experience at the WTO’s Eleventh Ministerial Conference in Buenos Aires highlights the difficulties of reaching a negotiated settlement on domestic support in isolation from, say, market access. Progress on disciplining export restrictions has also been stymied despite near unanimous agreement that export bans on humanitarian food aid should be prohibited.

Appellate Body crisis threatens the WTO Dispute Mechanism. A landmark achievement of the Uruguay Round, and notably, the Agreement on Agriculture, was the full inclusion of agriculture in multilateral rules and disciplines. Since the birth of the WTO, a significant number of member countries have used the dispute settlement mechanism (DSM) for resolving the disputes in agriculture. The DSM has played an important role not only for those parties involved in the disputes, but also by helping member countries to better understand the WTO rules, and therefore help guide them in developing domestic policies and trade policies that are consistent with WTO requirements.

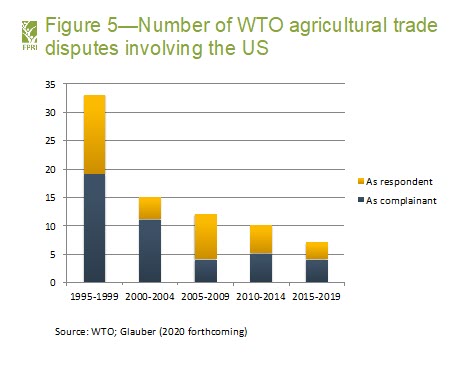

US agriculture has been a major beneficiary of the DSM. Over the period 1995-2019, the United States has brought 43 individual cases against WTO members involving an agricultural product; over the same period, 34 cases were brought against the US. Those numbers have declined over time, with only 7 disputes initiated within the past 5 years: 4 where the US was the complainant and 3 where it was the respondent (figure 5).

The greatest number of disputes were with WTO members who have been our largest trading partners (15 disputes with the EU, 11 disputes with Canada and 6 with Mexico) although in recent years, as developing countries have accounted for a larger share of global export and import, they have also accounted for a greater share of agricultural disputes.

Of the 43 cases taken by the US against other WTO members, a majority (26) of those were settled before going to a panel. Thus the WTO provides a forum where WTO members can resolve disputes without resorting to unilateral trade actions, which may ultimately be destructive and counterproductive. Of the 17 disputes that went to a panel, the panels agreed with 80 percent of the claims argued by the US in those disputes. These include recent positive rulings for the US in cases against China on agricultural subsidies and tariff rate quota (TRQ) administration.

The United States has also been a respondent in 34 disputes involving agriculture, 19 of which went to a panel for adjudication. In those cases, the panels agreed with complainants’ claims about 72 percent of the time. Among the more prominent cases include the case brought by Brazil against US cotton subsidies (DS267) and the disputes brought by Canada and Mexico against mandatory Country of Origin Labeling (COOL) (DS384 and DS386).

WTO members rely on dispute settlement proceedings to ensure transparency, clear rules on trade, and a fair system of trade for WTO member countries. Paralyzing the dispute settlement procedure would be a real loss to the global trading system. Beyond the immediate halt of proceedings, failure to make appointments could come at considerable costs to members’ long-term objectives and the stability of the multilateral trading system. The food system is one critical place where consequences could land: disputes over food products that escalate or cause damage to the multilateral system could potentially have human costs for countries that rely on food trade, exacerbating hunger and hurting food producers’ income opportunities. To avoid such economic and human costs, it is critical that WTO members find a resolution to the current Appellate Body crisis.

Conclusion

It is easy to be pessimistic about the future trade agenda of the WTO given the current state of global trade relations and threats of trade wars. Protectionist pressures have ebbed and flowed throughout history, however, and it is important to recall that within four years of passage of the Tariff Act of 1930 (more commonly known as the Smoot-Hawley Tariff Act), the US Congress passed the Reciprocal Trade Agreements Act of 1934, which in part led to the development of the GATT and the long period of trade liberalization that has followed to the present.

The challenges of meeting future food needs will require a concerted effort from governments to improve the functioning of food and agricultural markets. The WTO can play an enormous role by reducing trade-distorting support, improving market access, ending distortions caused by export restrictions and subsidies, and perhaps most importantly, continue to provide a forum to which members can bring and hopefully resolve, trade disputes, rather than engaging in unilateral trade actions that can quickly escalate trade tensions. In the words of the Deputy Director General Alan Wolff, the WTO remains “a place of hope, for the least developed, for the vulnerable, for the conflict-affected, for the industrialized, for any country seeking economic advancement for its people, and that is a category that must include all.” [3]

* The views expressed are those of the author and do not reflect those of the International Food Policy Research Institute or the American Enterprise Institute. The American Enterprise Institute in a nonpartisan, nonprofit, 501(c)(3) educational organization and does not take institutional positions on any issue.

[1] See Peterson Institute for International Economics, “Trump’s Trade War Timeline: an Up-to-Date Guide” Available at https://www.piie.com/sites/default/files/documents/trump-trade-war-timeline.pdf

[2] Glauber, J.W. 2019. “Agricultural Trade Aid: Implications and Consequences for US Global Trade Relationships in the Context of the World Trade Organization”. Washington, DC: American Enterprise Institute. https://www.aei.org/wp-content/uploads/2019/11/Agricultural-Trade-Aid-1.pdf

[3] Wolff, A. Wm. 2020. “Trade for peace is more than a slogan, it is hope for a better future.” Speech given at a virtual event hosted by American University, 17 July 2020. Available at: https://www.wto.org/english/news_e/news20_e/ddgaw_17jul20_e.htm